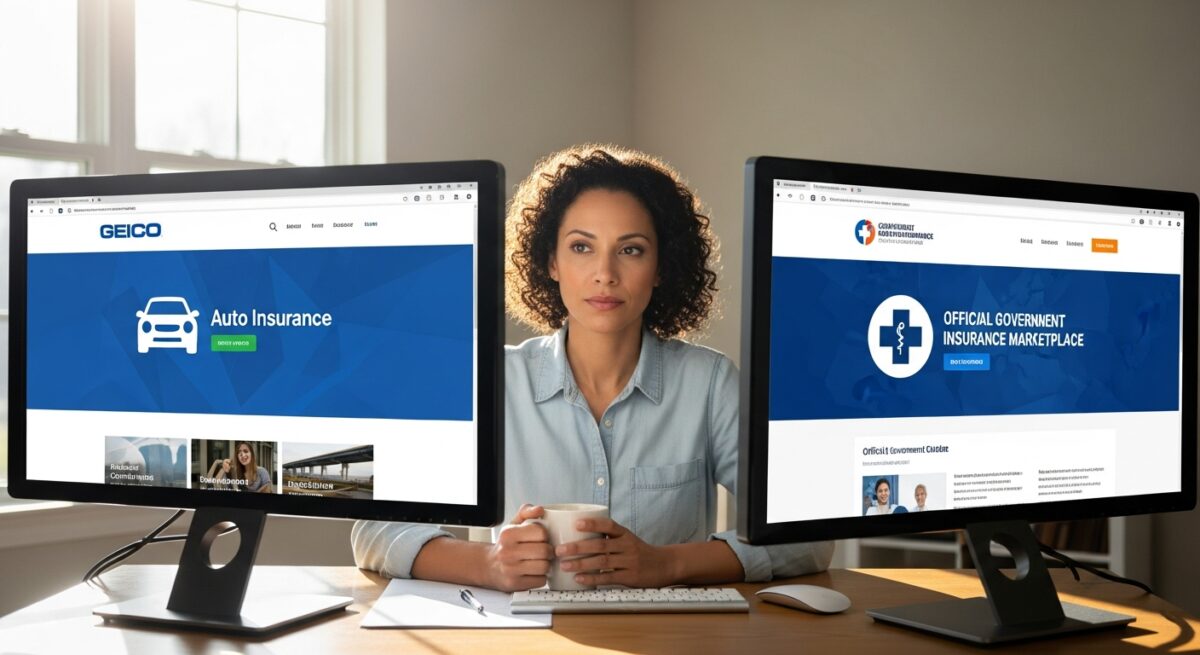

If you’re a Geico customer, you might be wondering if you can bundle your health insurance with your car insurance for a convenient, one-stop-shop experience. The question of a “Geico health insurance marketplace” is a common one, driven by the company’s strong brand recognition in the insurance sector. However, the reality of how Geico relates to health coverage is important for consumers to understand before they shop. This article clarifies Geico’s role, explains your actual options for finding health insurance, and provides a clear roadmap to securing the right plan for your needs.

Geico’s Role: Auto and More, But Not Health Insurance

Geico is a subsidiary of Berkshire Hathaway and is primarily a direct writer of property and casualty insurance. Its core products are auto, motorcycle, RV, homeowners, renters, and umbrella insurance. While Geico has expanded its offerings over the years, it does not underwrite, sell, or administer its own branded health insurance plans. There is no “Geico health insurance marketplace” in the sense of a platform where you can purchase a Geico health plan. The confusion often stems from the company’s advertising presence and the general consumer desire to consolidate insurance providers. It is crucial to distinguish between the types of insurance; health insurance is a fundamentally different product regulated and structured separately from the property insurance Geico specializes in.

Your Real Pathways to Health Insurance Coverage

Since Geico does not provide health insurance, you must look to other established channels. The good news is that several reliable avenues exist, each designed for different life circumstances. Understanding these pathways is the first step to getting covered. The primary sources for health insurance in the United States are the Health Insurance Marketplace (also known as the Exchange), employer-sponsored plans, government programs like Medicare and Medicaid, and private insurers directly.

The most common option for individuals and families who do not get insurance through a job is the Health Insurance Marketplace, established by the Affordable Care Act (ACA). This is a government-facilitated platform where you can compare plans from multiple private insurance companies, check your eligibility for financial assistance (premium tax credits and cost-sharing reductions), and enroll in coverage. For a detailed look at how a state-based exchange operates, you can explore our guide on the Oregon health insurance marketplace and its enrollment process. The rules and plan selections are similar across state and federal platforms.

Navigating the Health Insurance Marketplace

Accessing the Marketplace is straightforward. You can visit HealthCare.gov, which serves most states, or your state’s own Exchange website if it operates one. Enrollment is typically limited to an annual Open Enrollment Period, usually from November 1 to January 15, though you may qualify for a Special Enrollment Period if you experience a major life event like losing other coverage, getting married, or having a baby. When you apply, you’ll input information about your household size, income, and location. The system will then show you all available plans in your area, categorized into metal tiers: Bronze, Silver, Gold, and Platinum. These tiers indicate how you and the plan split costs, not the quality of care.

To make an informed decision, you should compare plans based on several key factors beyond just the monthly premium. Consider the following elements carefully:

- Deductible: The amount you pay for covered services before the plan begins to pay.

- Copayments and Coinsurance: Your share of the costs for a service (a fixed amount or a percentage).

- Out-of-Pocket Maximum: The most you’ll have to pay in a year for covered services.

- Provider Network: The list of doctors, hospitals, and clinics that participate in the plan.

- Prescription Drug Coverage: The formulary, or list of covered medications, and their associated costs.

Choosing a plan is a balance between monthly cost and potential out-of-pocket expense. A plan with a low premium often has a higher deductible, which is a suitable trade-off if you are generally healthy and don’t expect many medical expenses. Conversely, if you have ongoing health needs, a higher-premium plan with a lower deductible may save you money overall. Our resource on Geico health insurance cost delves deeper into the factors that influence premium pricing, which are applicable to any insurer you consider.

Alternative Health Insurance Options

Beyond the ACA Marketplace, other sources of coverage may be available to you. Employer-sponsored insurance remains the most common source of coverage for Americans under 65. If you or your spouse has access to a plan through work, this is often a cost-effective option, as employers typically pay a portion of the premium. Government programs provide vital coverage for specific groups. Medicare is federal health insurance for people 65 or older, certain younger people with disabilities, and people with End-Stage Renal Disease. Medicaid, and the related Children’s Health Insurance Program (CHIP), provide coverage to eligible low-income adults, children, pregnant women, elderly adults, and people with disabilities. Eligibility for Medicaid is based on income and varies by state.

You can also purchase health insurance directly from an insurance company or through a licensed agent or broker outside the Marketplace. This is known as “off-Exchange” coverage. The important note here is that plans sold outside the Marketplace are still required to comply with ACA standards, offering the same essential health benefits. However, you will not be eligible for premium tax credits or cost-sharing reductions on an off-Exchange plan. This route may be worth exploring if your income is too high for subsidies and you want to see a broader range of plan designs from a specific insurer.

Maximizing Your Insurance Strategy

Even though you cannot get health insurance from Geico, you can still manage your insurance portfolio strategically. Bundling your property and casualty insurance with one provider, like Geico, can often lead to significant discounts on your auto, home, or renters policies. This frees up your budget and simplifies the management of those coverages. You can then separately secure the best possible health insurance plan for your medical needs through the appropriate channels discussed. This separation of specialties allows you to get the best value and expertise in each domain. Always ensure you are comparing health plans during Open Enrollment and reviewing your coverage annually, as your health needs and plan offerings can change.

Frequently Asked Questions

Does Geico sell any kind of health-related insurance?

Geico does offer some supplemental products that are health-adjacent, such as hospital indemnity plans or accident insurance. These are not comprehensive major medical health insurance. They are designed to provide fixed cash benefits for specific events (like a hospital stay or an accident) to help with out-of-pocket costs, but they do not meet the ACA requirement for minimum essential coverage.

If I see “Geico” and “health insurance” together in a search, what am I seeing?

You are likely seeing online advertisements or content from third-party lead generators or insurance aggregator sites. These sites may use Geico’s name in search engine marketing to attract users looking for insurance quotes broadly. They are not operated by Geico and will redirect you to other health insurance providers or the Marketplace.

Can I get a discount on health insurance if I have Geico auto insurance?

No. Health insurers and property/casualty insurers like Geico are separate entities with no cross-discount programs for bundling different lines of insurance. Discounts for bundling only apply within a company’s own product offerings.

What is the most reliable way to find affordable health insurance?

The most reliable method is to use the official Health Insurance Marketplace at HealthCare.gov or your state’s site. There, you can get an accurate determination of your subsidy eligibility and compare all available ACA-compliant plans in your area. Working with a licensed, non-commissioned assister (like a Navigator) can also provide free, unbiased help.

Securing the right health insurance is a critical component of your financial and physical well-being. While Geico is not a player in this specific field, the systems to find quality, affordable coverage are well-established and accessible. By focusing your search on the Health Insurance Marketplace, employer plans, or government programs, you can find a plan that offers the protection you need. Remember to prioritize understanding the plan details, network, and costs over the brand name of the insurer, and make use of available resources and enrollment periods to make a confident decision.

About Elliot Kingsley

For over a decade, my professional compass has been guided by a single mission: to demystify the complex world of health insurance for individuals, families, and self-employed professionals. I have dedicated my career to analyzing policies, comparing provider networks, and breaking down the fine print that often leaves consumers uncertain. My expertise is particularly deep in evaluating national carriers and state-specific markets, with a thorough focus on understanding the offerings and customer experiences of major insurers like Blue Cross Blue Shield, Anthem, and Ambetter. This involves continuously researching and publishing detailed reviews to help readers identify the best health insurance companies and plans for their unique situations. My writing and research routinely cover critical topics such as navigating the state-based exchanges from Alabama to Alaska and Arizona to Arkansas, ensuring residents understand their local options. A significant portion of my work is also devoted to serving the growing independent workforce, where I identify the best health insurance strategies for freelancers who must navigate coverage without employer sponsorship. I combine data-driven analysis with a clear, accessible writing style to transform industry jargon into actionable advice. Ultimately, my goal is to empower you with the knowledge needed to make confident, informed decisions about your healthcare coverage in an ever-evolving landscape.

Read More