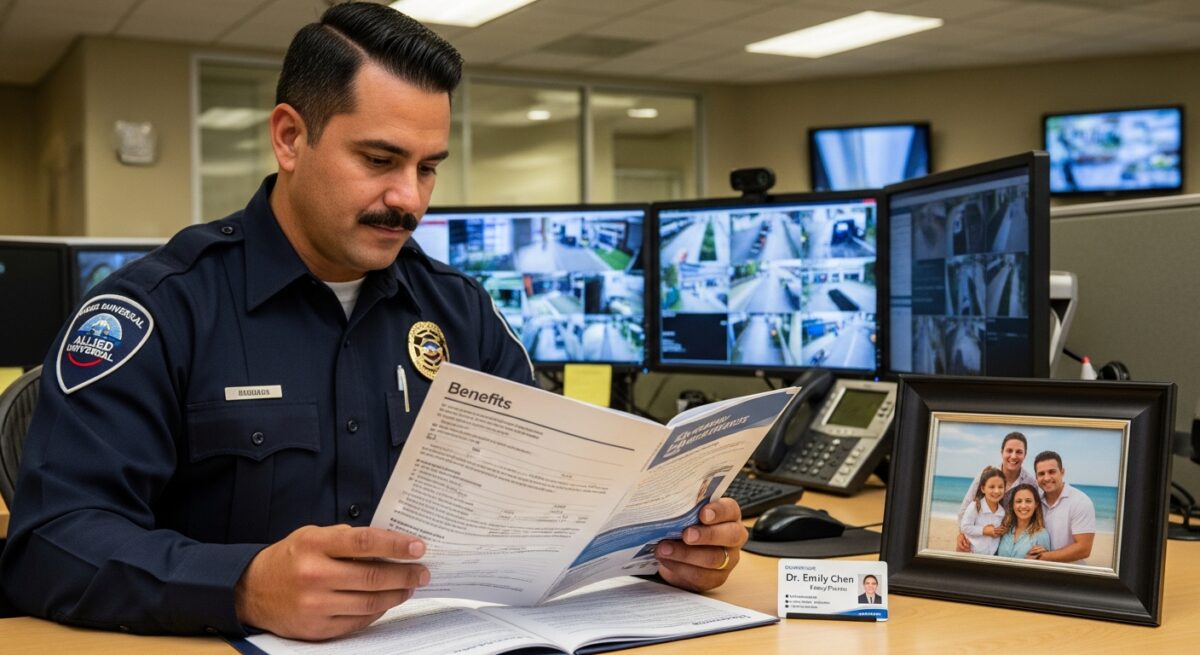

Understanding the health insurance benefits offered by your employer is crucial, especially in a physically demanding field like security services. For the hundreds of thousands of professionals working for Allied Universal, one of the world’s leading security and facility services companies, navigating the specifics of their health insurance plans is a top priority. These benefits are a key component of total compensation, providing financial protection and access to necessary medical care for employees and their families. This article provides a comprehensive overview of what Allied Universal security health insurance typically entails, how to navigate enrollment, and important considerations for making the most of your coverage.

Understanding Allied Universal’s Health Insurance Offerings

Allied Universal, as a large employer, typically provides a range of health insurance options to its eligible employees. The specifics of the plans, including carriers, network types, and premium costs, can vary based on several factors. The most significant variables include the employee’s location (state), their employment status (full-time vs. part-time), and the collective bargaining agreements if they are part of a union. Generally, full-time employees are eligible for benefits, while part-time employees may have limited or different options. The company often partners with national and regional insurance carriers to offer Preferred Provider Organization (PPO) and Health Maintenance Organization (HMO) plans. Understanding the core differences between these plan types is the first step in selecting the right coverage for your needs.

A PPO plan usually offers more flexibility, allowing you to see specialists without a referral and visit out-of-network providers (though at a higher cost). An HMO plan typically requires you to choose a primary care physician (PCP) and get referrals for specialists, but it often comes with lower monthly premiums and predictable copays. Allied Universal’s benefits package likely includes more than just medical insurance. It often encompasses a suite of well-being tools, including dental and vision coverage, prescription drug plans, and mental health resources. Some plans may also offer wellness programs that provide incentives for healthy behaviors, which can be particularly valuable for security professionals managing stressful shifts.

Key Components of Your Health Insurance Plan

When evaluating your Allied Universal security health insurance options, it’s essential to look beyond just the monthly premium deducted from your paycheck. Several other cost-sharing mechanisms define how much you will pay for care. The deductible is the amount you pay out-of-pocket for covered services before your insurance plan starts to pay. Plans with higher deductibles usually have lower monthly premiums. Once you meet your deductible, you typically pay a copayment (a fixed fee) or coinsurance (a percentage of the cost) for services, while the plan pays the rest, up to the plan’s limits.

Your out-of-pocket maximum is a critical safety net. This is the most you will have to pay for covered services in a plan year. After you spend this amount on deductibles, copayments, and coinsurance, your health plan pays 100% of the costs of covered benefits. Carefully reviewing these elements, along with the plan’s provider network, will help you estimate your potential healthcare expenses. For a deeper dive into how these benefits work for employees, our guide on Allied Universal employee health insurance benefits breaks down the typical structure in more detail.

Enrollment and Eligibility Details

Eligibility for Allied Universal health insurance is generally tied to your employment classification. Most companies require employees to work a minimum number of hours per week (often 30 or more) to be considered full-time and eligible for benefits. There are specific enrollment periods you must adhere to. The initial enrollment period occurs when you are first hired and become eligible. This window is typically 30 days from your eligibility date. If you miss this period, you usually must wait for the annual Open Enrollment period, which typically happens once a year, often in the fall for a January 1st start date.

Qualifying life events, such as marriage, the birth of a child, or loss of other coverage, may trigger a Special Enrollment Period, allowing you to enroll or make changes outside the standard windows. It is imperative to consult the official Allied Universal employee benefits portal or speak with the HR department for the exact dates, eligibility rules, and required documentation for your specific situation. Failure to enroll during the proper period could mean going without coverage until the next opportunity.

Maximizing Your Health Insurance Benefits

Simply having insurance is not enough, you need to use it strategically to get the best value and care. Start by thoroughly understanding your plan documents, often called the Summary of Benefits and Coverage (SBC). This document clearly outlines what is covered, your costs, and any exclusions or limitations. Always try to use in-network providers whenever possible to avoid significantly higher out-of-network charges. Most plans offer an online directory or a customer service number to help you find doctors, hospitals, and labs within the network.

Take advantage of preventive care services, which are usually covered at 100% with no cost-sharing when using an in-network provider. This includes annual check-ups, immunizations, and cancer screenings. Managing chronic conditions effectively through regular, in-network care can prevent more serious and expensive health issues later. Furthermore, if your Allied Universal plan includes a Health Savings Account (HSA) paired with a High-Deductible Health Plan (HDHP), consider contributing to it. HSAs offer triple tax advantages: contributions are tax-deductible, growth is tax-free, and withdrawals for qualified medical expenses are tax-free. This can be a powerful tool for saving for current and future healthcare costs.

Here are three actionable steps to ensure you are optimizing your Allied Universal health coverage:

- Review your plan’s preventive care list and schedule annual appointments.

- Before any non-emergency procedure, verify the provider’s network status and obtain a cost estimate.

- Utilize any offered telehealth services for convenient, often lower-cost consultations for minor ailments.

Staying informed and proactive is the best way to navigate the healthcare system. For individuals exploring all their options, including those who may be considering coverage outside of an employer, understanding the landscape of individual health insurance plans is also valuable context.

Frequently Asked Questions

What health insurance carriers does Allied Universal use?

Allied Universal contracts with various insurance carriers that can differ by state and region. Common carriers may include national providers like UnitedHealthcare, Aetna, Cigna, or regional Blue Cross Blue Shield affiliates. You must check your specific benefits materials or the employee portal for your assigned carriers.

Are dental and vision insurance included?

Yes, Allied Universal typically offers voluntary dental and vision insurance plans as part of its benefits package. These are often separate from the medical plan and may require an additional premium. Coverage details and network providers will vary.

Can I add my family members to my Allied Universal health plan?

In most cases, yes. Eligible employees can usually enroll their spouse, domestic partner, and dependent children (often up to age 26) in their health, dental, and vision plans. Adding dependents will increase your bi-weekly or monthly premium contributions.

What happens to my health insurance if I leave Allied Universal?

Your coverage will typically end on your last day of employment or at the end of the month in which you leave. You will be offered COBRA continuation coverage, which allows you to keep the same group plan for a limited time (usually 18 months) by paying the full premium yourself, plus a small administrative fee. This can be expensive but provides continuous coverage while you seek new insurance.

Where can I get the most current information about my benefits?

The definitive source for your personal benefits information is the Allied Universal employee self-service portal or your local Human Resources representative. They can provide plan documents, carrier contacts, and answers specific to your enrollment status and location.

Navigating employer-sponsored health insurance is a critical task for financial and physical well-being. By taking the time to understand your Allied Universal security health insurance options, you make empowered decisions for yourself and your family. Remember that benefits can change annually, so reviewing your choices during each Open Enrollment period is essential. For more comprehensive analysis on selecting and using health plans effectively, you can always Read full article for deeper insights. Ultimately, your health coverage is a vital tool, and using it wisely ensures you get the protection you need from one of your most important employment benefits.

About Alana Kirkwood

My journey into the world of health insurance began with a personal quest to understand the intricate system that so many of us navigate with uncertainty, especially when seeking the best health insurance for freelancers and independent professionals. Over the years, I have dedicated my career to demystifying coverage options, from analyzing major carriers like Blue Cross Blue Shield to providing detailed anthem health insurance reviews and ambetter health insurance reviews. My expertise is built on a foundation of rigorously comparing plans, dissecting policy details, and tracking the performance of the best health insurance companies in the USA to provide clear, actionable guidance. My analysis spans the diverse landscape of state-specific markets, including Alabama Health Insurance, Alaska Health Insurance, Arizona Health Insurance, and Arkansas Health Insurance, understanding that local regulations and carrier networks are crucial to finding the right fit. I leverage this extensive research to help individuals and families cut through the complexity, whether they are evaluating ADP Health Insurance offerings through an employer or shopping on the individual marketplace. My goal is to translate industry jargon into straightforward advice, empowering readers to make confident, informed decisions about their healthcare coverage and financial well-being.

Read More